Introduction to RSI

The Relative Strength Index (RSI) is a technical analysis tool that measures the speed and change of price movements. It was developed by J. Welles Wilder, a mechanical engineer and real estate developer, in 1978. RSI is used to identify overbought or oversold conditions in a market, and it can also provide signals for potential trend reversals.

Understanding the RSI

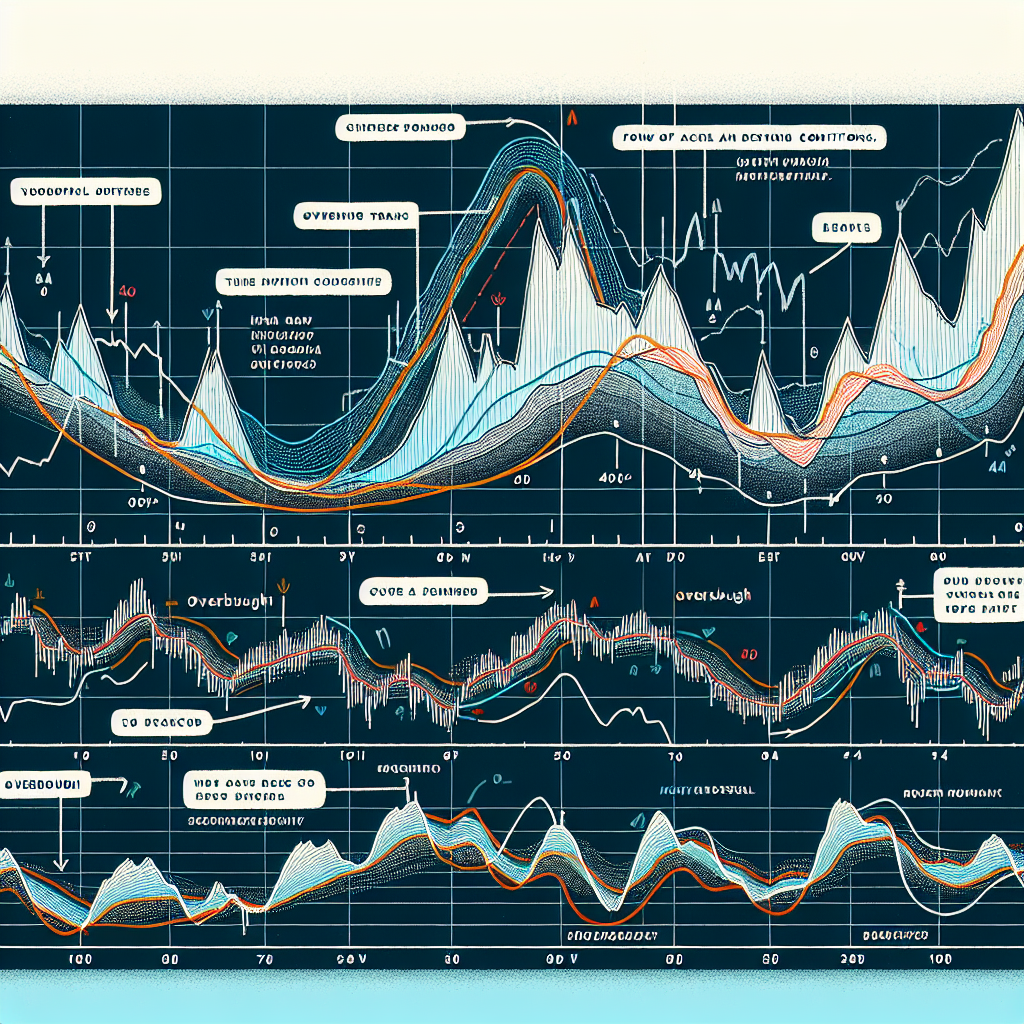

The RSI is a momentum oscillator that moves between 0 and 100. It is calculated using the average gains and losses of a specific period, usually 14 periods. When the RSI is above 70, it indicates that a security is overbought and could be primed for a trend reversal or corrective pullback in price. On the other hand, an RSI reading of 30 or below indicates an oversold or undervalued condition.

Using RSI to Identify Market Momentum

Step 1: Plotting the RSI

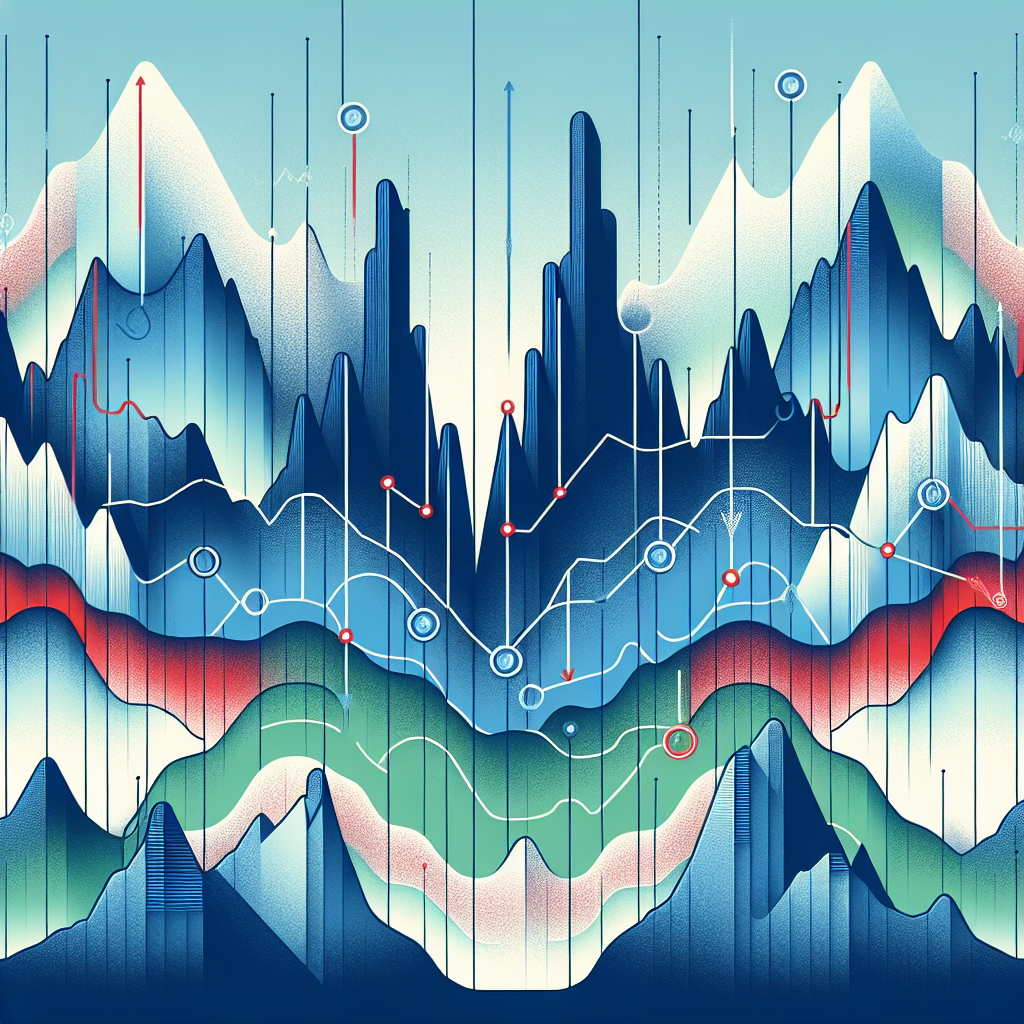

The first step in using RSI to identify market momentum is to plot the RSI on a chart. This is typically done in a separate window below the price chart. Most charting software will have the RSI as a standard tool in their package.

Step 2: Identifying Overbought and Oversold Conditions

Once you have plotted the RSI, you can start to identify overbought and oversold conditions. If the RSI is above 70, the market is considered overbought, and if it is below 30, the market is considered oversold. These conditions suggest that a price correction or reversal is likely.

Step 3: Looking for Divergences

Divergences occur when the price of an asset and the RSI are moving in opposite directions. For example, if the price is making higher highs but the RSI is making lower highs, this is known as bearish divergence and could indicate that the upward momentum is slowing.

Step 4: Using RSI as a Trend Confirmation Tool

In addition to identifying potential reversals, RSI can also be used as a trend confirmation tool. If the RSI is above 50, it generally means that the uptrend is intact, and if it is below 50, it indicates that the downtrend is intact.

Limitations of RSI

While the RSI is a powerful tool, it should not be used in isolation. It is best used in conjunction with other technical analysis tools and indicators. Also, it’s important to remember that the RSI is a lagging indicator, meaning it follows price action and trends, it does not predict them.

Conclusion

In conclusion, the RSI is a valuable tool that can help traders identify market momentum and potential trend reversals. However, like all technical analysis tools, it is not infallible and should be used in conjunction with other indicators and analysis methods. By understanding how to correctly interpret and use the RSI, traders can gain a significant edge in the market.