Introduction to Advanced Ichimoku Cloud Strategies

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile technical analysis tool that offers a comprehensive view of the market. It provides insights into market direction, momentum, and support and resistance levels. Although it may appear complex at first glance, with a little practice, you can harness its full potential. This article will delve into some advanced Ichimoku Cloud strategies that can significantly enhance your trading decisions.

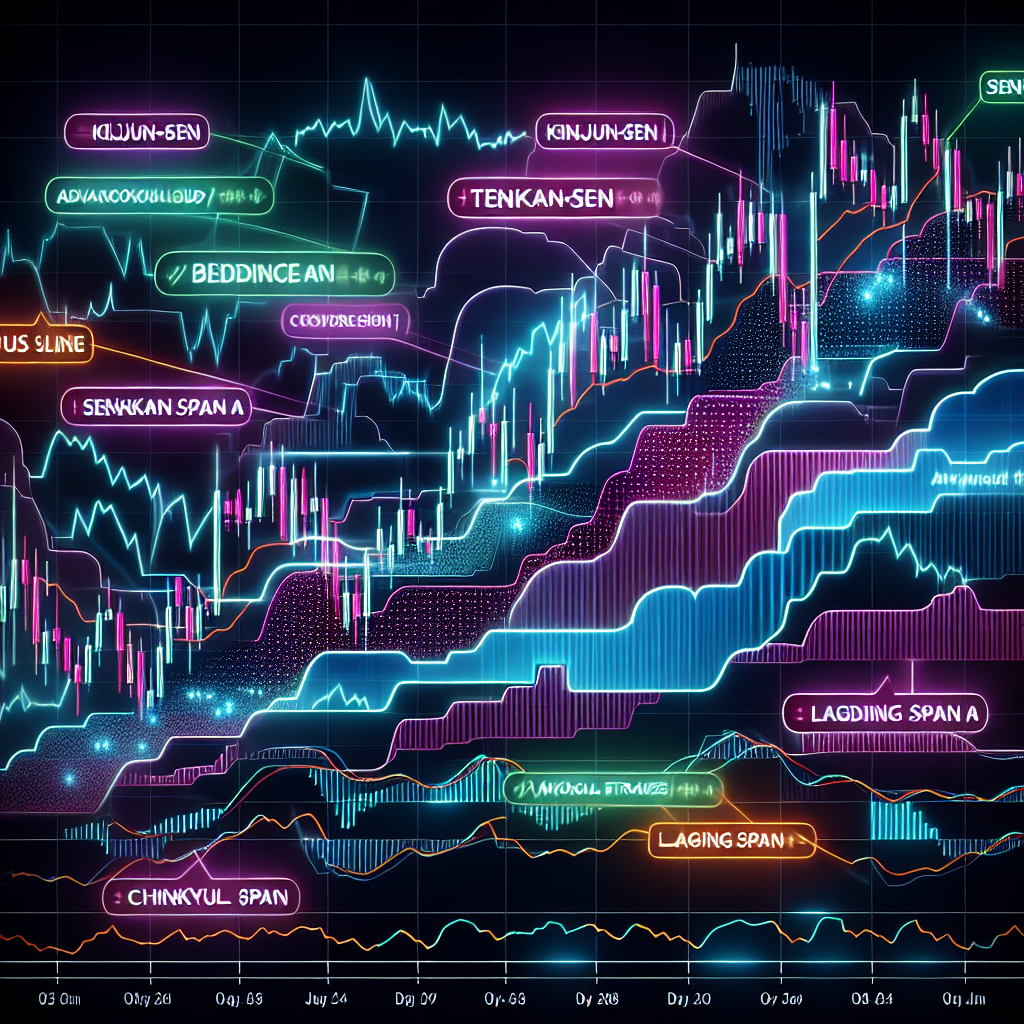

Understanding the Ichimoku Cloud

Before diving into the advanced strategies, it’s essential to understand the basic components of the Ichimoku Cloud. It consists of five lines: Tenkan-Sen, Kijun-Sen, Senkou Span A, Senkou Span B, and Chikou Span. Each line provides unique insights into the market, and together they form the Ichimoku Cloud.

Advanced Ichimoku Cloud Strategies

1. The Chikou Span Breakout Strategy

The Chikou Span, or lagging line, is plotted 26 periods behind the current price and can help identify potential breakouts. If the Chikou Span breaks above the cloud during an uptrend, it signals a strong bullish momentum. Conversely, if it breaks below the cloud during a downtrend, it indicates a robust bearish momentum. This strategy can be particularly useful in volatile markets.

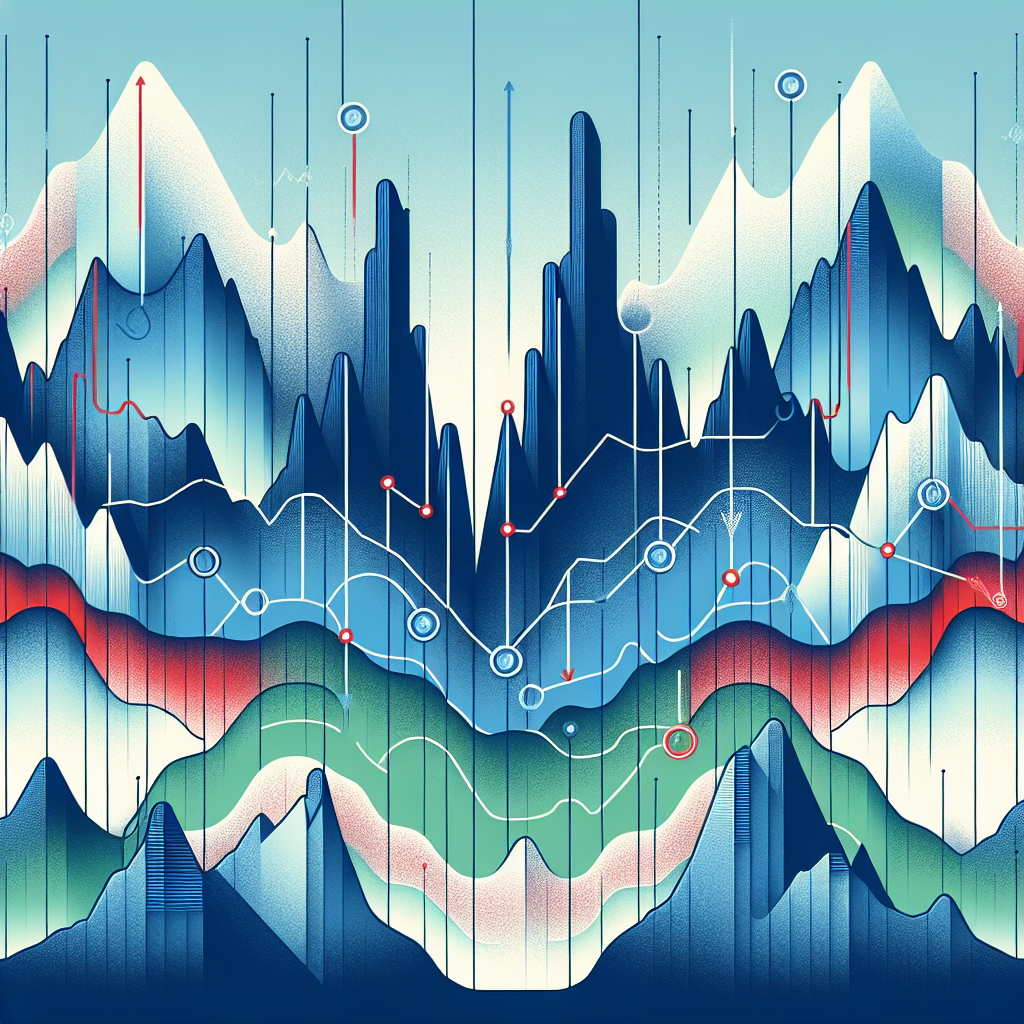

2. The Kumo Twist Strategy

The Kumo, or cloud, is formed by Senkou Span A and Senkou Span B. When these two lines cross each other, it creates a ‘Kumo Twist.’ If Senkou Span A crosses above Senkou Span B, it’s a bullish signal. If Senkou Span A crosses below Senkou Span B, it’s a bearish signal. This strategy can help traders anticipate potential reversals in the market.

3. The Price-Cross Strategy

This strategy involves monitoring the price in relation to the cloud. If the price crosses above the cloud, it’s a bullish signal. If the price crosses below the cloud, it’s a bearish signal. This strategy is simple yet effective, especially when combined with other Ichimoku Cloud components.

4. The Tenkan-Kijun Cross Strategy

The Tenkan-Sen and Kijun-Sen lines can also provide valuable trading signals. When the Tenkan-Sen crosses above the Kijun-Sen, it’s a bullish signal. When the Tenkan-Sen crosses below the Kijun-Sen, it’s a bearish signal. This strategy is often referred to as the ‘TK Cross.’

Conclusion

The Ichimoku Cloud is a powerful tool that can provide a wealth of information about the market. By understanding its components and how they interact, traders can develop advanced strategies that can significantly enhance their trading decisions. However, as with any trading tool, it’s essential to use the Ichimoku Cloud in conjunction with other technical analysis tools and indicators to confirm signals and reduce the risk of false signals.