Introduction to Support and Resistance Level Strategies

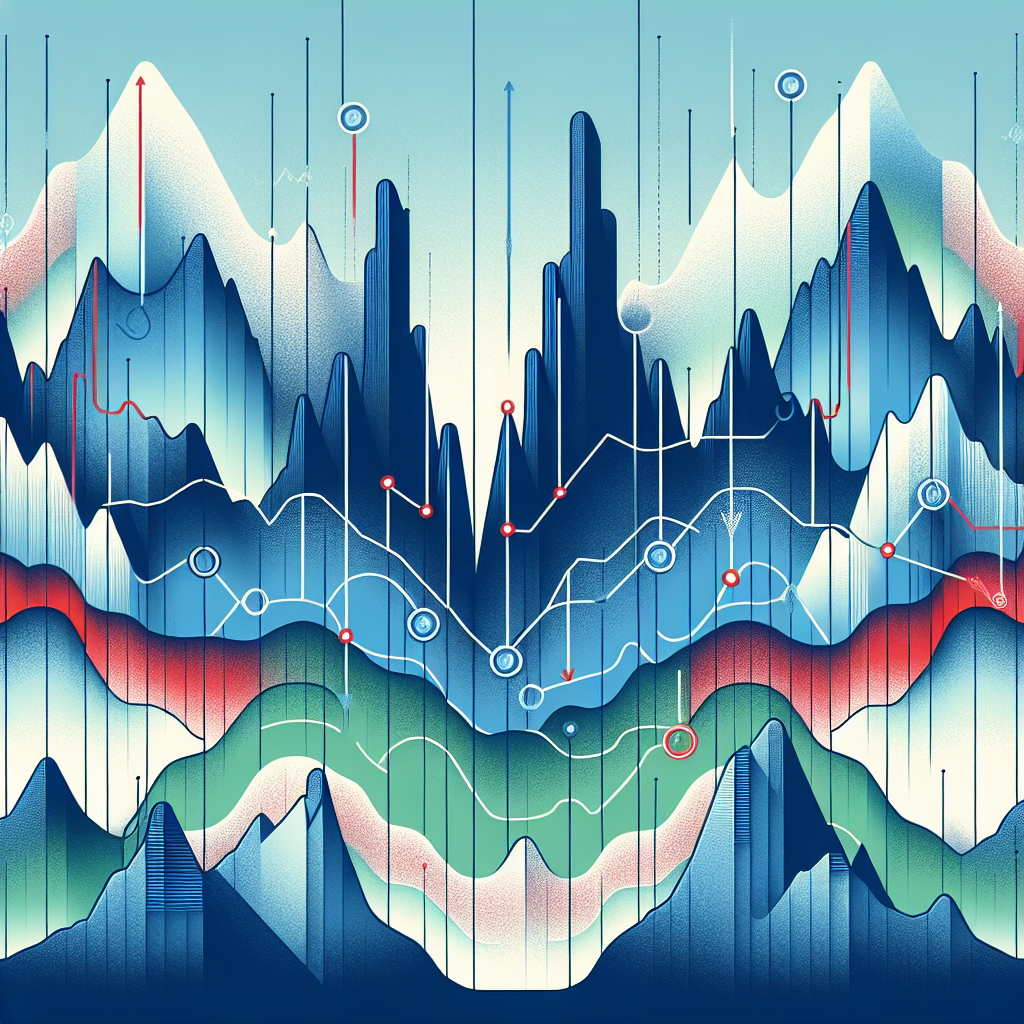

Support and resistance levels are one of the most fundamental, yet effective strategies in the world of forex and stock trading. These levels help traders to make decisions about buying or selling an asset, based on its historical performance. Support and resistance levels are essentially psychological benchmarks where the price tends to struggle to move beyond.

Understanding Support and Resistance Levels

Before diving into strategies involving these levels, it’s crucial to understand what they are.

Support Level

A support level is a price level where the asset’s price tends to find support as it’s falling. This means the price is more likely to ‘bounce’ off this level rather than break through it. However, once the price has breached this level, it is likely to continue dropping until it finds another support level.

Resistance Level

On the other hand, a resistance level is a price at which an asset has historically had difficulty exceeding. As the price approaches the resistance level, sellers start to outnumber buyers, creating a surplus that prevents the price from rising any further.

Strategies Using Support and Resistance Levels

Now that we understand what support and resistance levels are, let’s look at some strategies that traders use involving these levels.

1. The Bounce

In this strategy, traders wait for the price to bounce off known support or resistance levels before entering a trade. This can be a safer strategy because it allows the trader to enter a position at a more favorable price.

2. The Break

Another strategy is to trade the break of a support or resistance level. Traders wait for the price to break through a level, then enter a trade hoping that the price will continue in the same direction. This strategy can be more risky because the price could reverse direction after breaking the level.

3. The Test

The test strategy involves waiting for the price to break a support or resistance level, then waiting for it to come back and test the level again before entering a trade. This strategy can provide the best of both worlds: it allows the trader to enter a position at a favorable price, but also provides confirmation that the break is likely to hold.

Conclusion

Support and resistance levels are powerful tools that traders can use to make informed decisions. By understanding these levels and the strategies that can be used with them, traders can increase their chances of making profitable trades. However, as with any trading strategy, it’s important to manage risk and use stop losses to protect against potential losses.