Introduction to MACD Crossovers

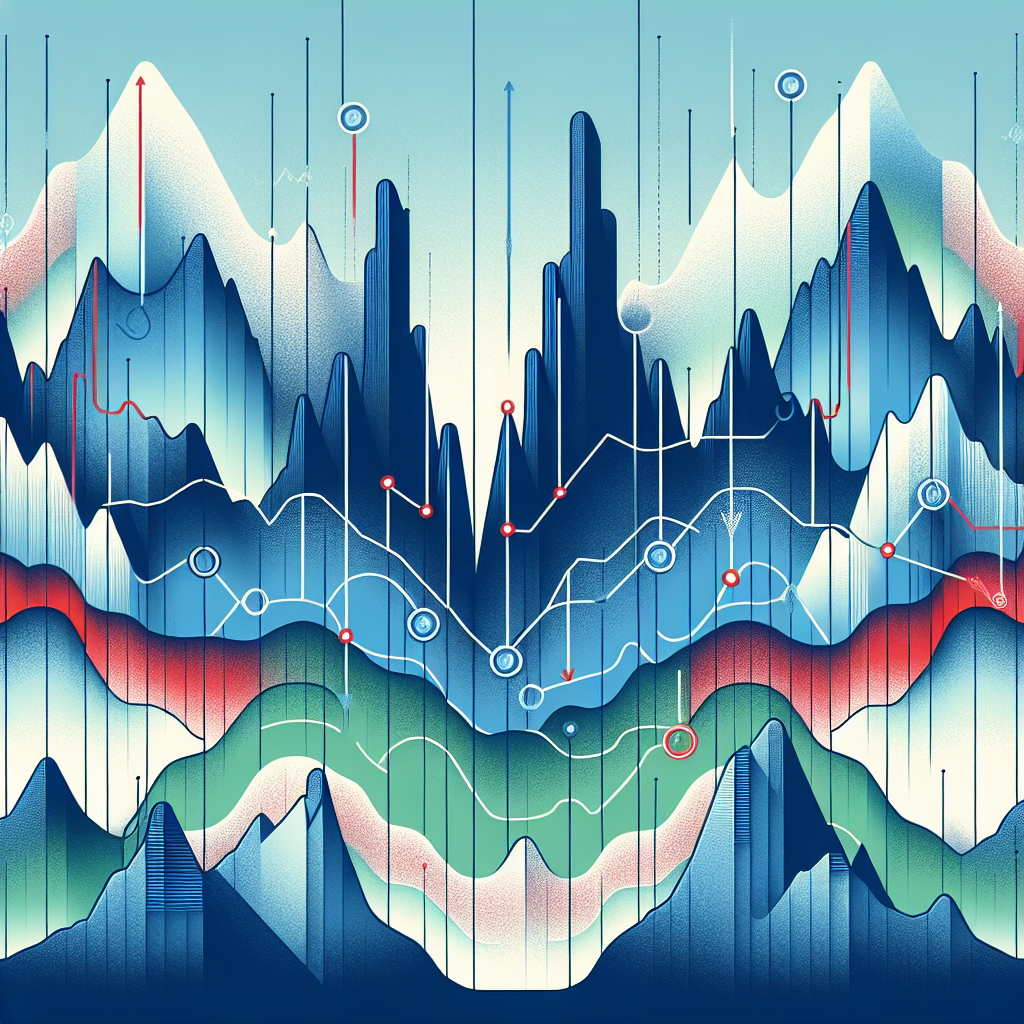

The Moving Average Convergence Divergence (MACD) is a technical analysis tool that traders use to identify potential buy and sell signals. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD, called the “signal line,” is then plotted on top of the MACD, functioning as a trigger for buy and sell signals.

Understanding MACD Crossovers

In trading, a MACD crossover occurs when the MACD line crosses above or below the signal line. When the MACD crosses above the signal line, it gives a bullish signal, indicating that it might be a good time to buy. Conversely, when the MACD crosses below the signal line, it gives a bearish signal, suggesting that it might be a good time to sell.

Types of MACD Crossovers

There are two types of MACD crossovers: bullish and bearish.

1. Bullish Crossover: This occurs when the MACD line crosses above the signal line. It is a signal to buy or go long.

2. Bearish Crossover: This happens when the MACD line crosses below the signal line. It is a signal to sell or go short.

Trading with MACD Crossovers

Trading with MACD crossovers involves observing the MACD line and the signal line on a MACD histogram. When these lines cross, it can suggest a change in the market trend, providing a potential trading opportunity.

Steps to Trade with MACD Crossovers

Step 1: Observe the MACD Line and Signal Line

The first step is to observe the MACD line and the signal line on the MACD histogram. You’re looking for instances where the MACD line crosses the signal line.

Step 2: Identify the Type of Crossover

Next, identify the type of crossover. If the MACD line crosses above the signal line, it’s a bullish crossover, suggesting a potential opportunity to buy. If the MACD line crosses below the signal line, it’s a bearish crossover, indicating a potential opportunity to sell.

Step 3: Consider Other Market Factors

Before making a trade based on a MACD crossover, consider other market factors. These could include the current market trend, other technical analysis indicators, and recent news events. The MACD crossover is just one signal, and it’s important to consider it in the context of other market information.

Step 4: Execute the Trade

Once you’ve identified a potential trading opportunity and considered other market factors, it’s time to execute the trade. Remember, no technical analysis tool is 100% accurate, so it’s important to manage your risk by using stop losses and other risk management strategies.

Conclusion

MACD crossovers can provide valuable trading signals, but they should be used in conjunction with other technical analysis tools and market information. By carefully observing the MACD line and signal line, identifying the type of crossover, considering other market factors, and managing your risk, you can use MACD crossovers to inform your trading decisions.