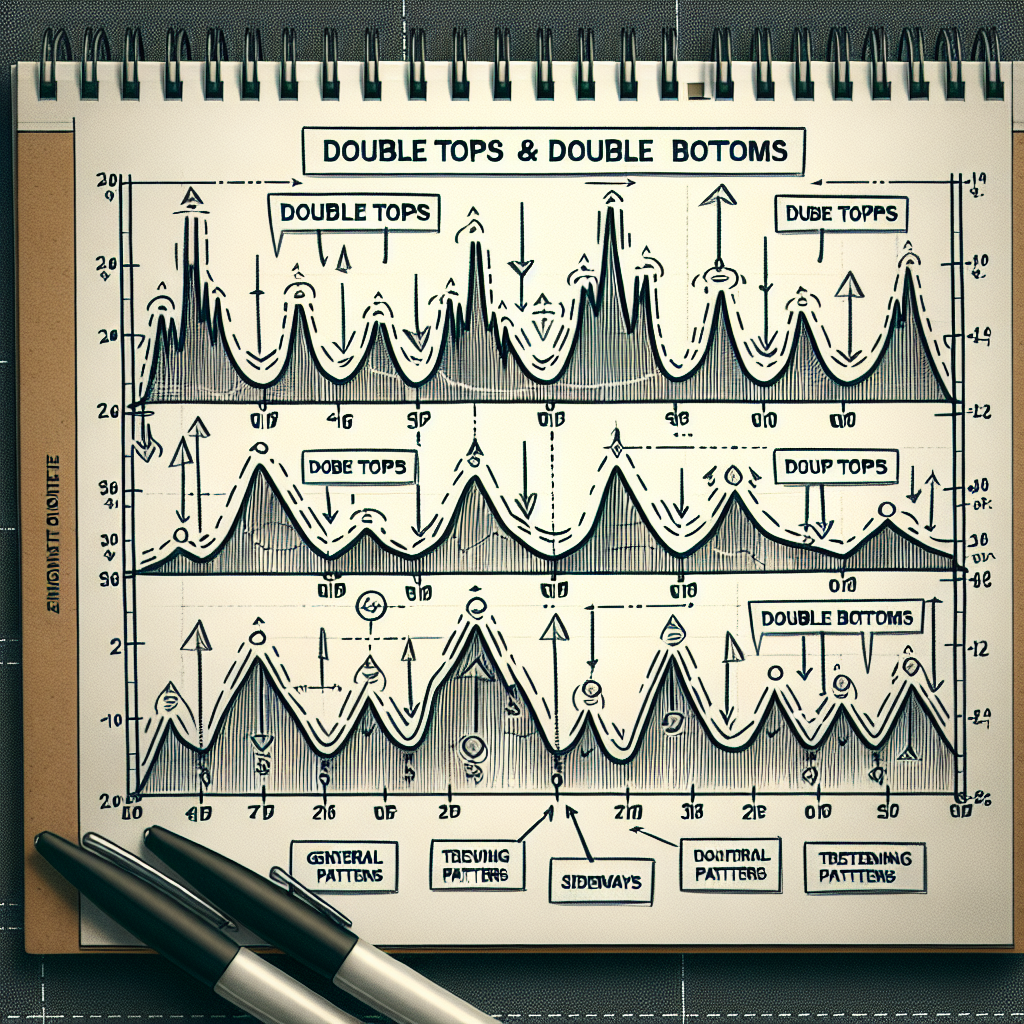

Recognizing Double Tops and Bottoms in Trading

Understanding trading patterns is a fundamental part of technical analysis in the world of investing. Among these patterns, double tops and double bottoms are the most commonly recognized and utilized by traders. These patterns can provide significant insights into potential reversals in the market, offering opportunities for profitable trading. This article will guide you through recognizing and understanding these patterns.

What are Double Tops and Double Bottoms?

Double tops and double bottoms are chart patterns used in technical analysis to predict reversals in a price trend. A double top forms after an uptrend and is seen as a signal that the market could be headed for a downturn. Conversely, a double bottom forms after a downtrend and is seen as a signal that the market could be headed for an upturn.

Recognizing Double Tops

Step 1: Identifying an Uptrend

The first step in recognizing a double top is identifying an uptrend. This is a period where the prices are generally rising, and is characterized by higher highs and higher lows.

Step 2: Spotting the First Peak

After an uptrend, look for a peak or ‘top’ in the price. This is the first part of the double top. After reaching this peak, prices will typically fall, creating what is known as a ‘trough’ or ‘valley’.

Step 3: Identifying the Second Peak

Following the trough, prices will rise again to form a second peak. This peak should be approximately at the same level as the first peak. The failure of the price to rise above the level of the first peak is a strong indication of a potential market reversal.

Step 4: Noticing the Break

The final confirmation of a double top pattern is a break below the lowest point of the trough between the two peaks. This is known as the ‘neckline’. When prices fall below this level, it is a strong signal that a downtrend is underway.

Recognizing Double Bottoms

Step 1: Identifying a Downtrend

Similar to recognizing double tops, the first step in recognizing a double bottom is identifying a downtrend. This is a period where prices are generally falling, characterized by lower lows and lower highs.

Step 2: Spotting the First Trough

After a downtrend, look for a trough or ‘bottom’ in the price. This is the first part of the double bottom. After reaching this trough, prices will typically rise, creating a ‘peak’.

Step 3: Identifying the Second Trough

Following the peak, prices will fall again to form a second trough. This trough should be approximately at the same level as the first trough. The failure of the price to fall below the level of the first trough is a strong indication of a potential market reversal.

Step 4: Noticing the Break

The final confirmation of a double bottom pattern is a break above the highest point of the peak between the two troughs. This is known as the ‘neckline’. When prices rise above this level, it is a strong signal that an uptrend is underway.

Conclusion

Recognizing double tops and double bottoms can be a powerful tool in predicting market reversals. However, it is important to remember that these patterns are not foolproof and should be used in conjunction with other technical analysis tools for the best results. As with all trading strategies, practice and experience are key to success.