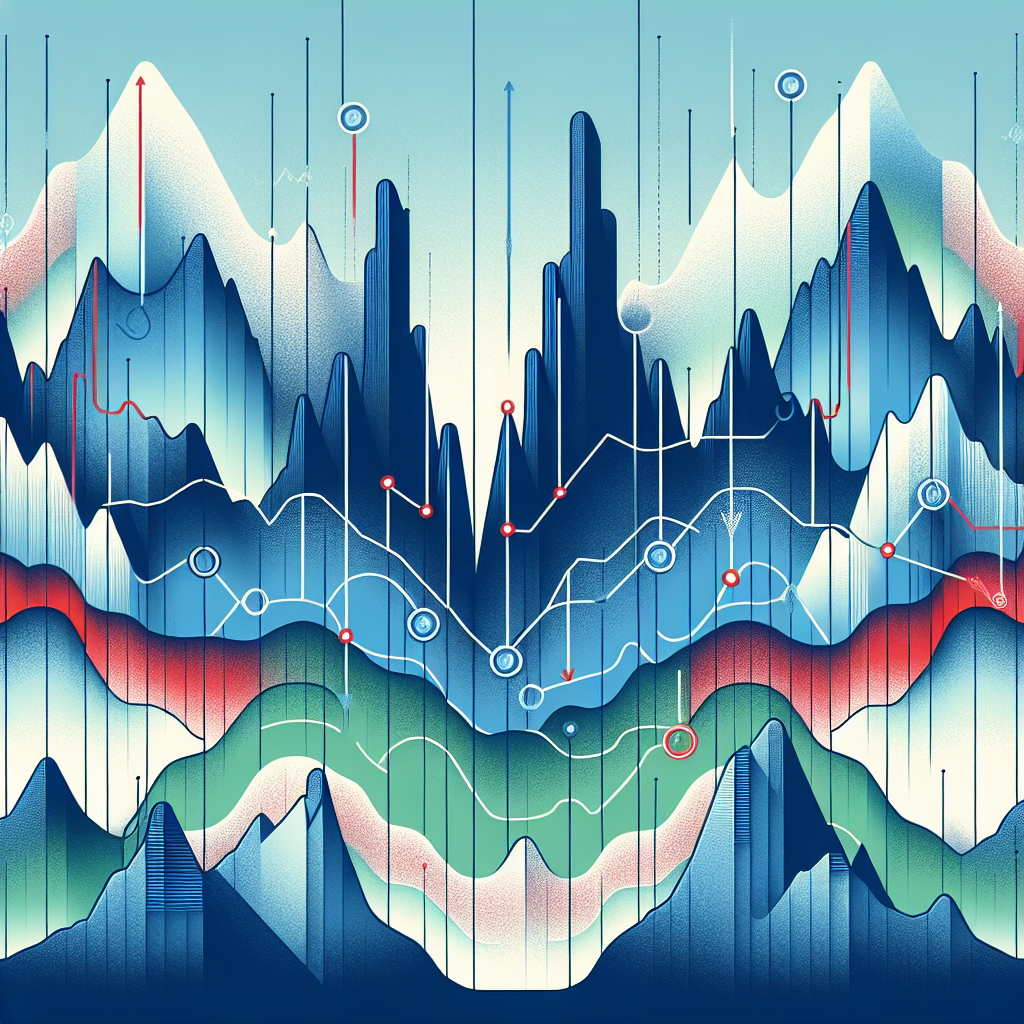

Introduction to Harmonic Trading Patterns

Harmonic trading patterns are a type of technical analysis used by traders to predict future market movements. Developed by Scott Carney in 1998, harmonic patterns are based on the recognition of specific price structures and the alignment of exact Fibonacci ratios to determine highly probable reversal points in the financial markets. This methodology assumes that trading patterns or cycles, like many patterns and cycles in life, repeat themselves.

The Importance of Harmonic Trading Patterns

Harmonic trading patterns are a sophisticated method of technical analysis that can provide traders with precise, quantifiable, and systematic trading opportunities. They offer an objective view of the market, allowing traders to make informed decisions based on the recognition of patterns.

Accuracy

One of the most significant advantages of harmonic trading patterns is their accuracy. They can predict market reversals with a high degree of accuracy by identifying the ‘potential reversal zones’ (PRZ).

Risk Management

Another advantage of harmonic trading patterns is that they provide clear and defined risk levels. Traders can set stop-loss orders beyond the completion of the pattern, which can help to limit potential losses.

Common Harmonic Trading Patterns

There are several harmonic trading patterns that traders commonly use. These include the Gartley pattern, the Bat pattern, the Butterfly pattern, and the Crab pattern.

The Gartley Pattern

The Gartley pattern, named after H.M Gartley who introduced it in his book “Profits in the Stock Market”, is one of the most traded harmonic patterns. This pattern is characterized by an ‘M’ shape on a price chart and is defined by four distinct Fibonacci price relationships.

The Bat Pattern

The Bat pattern is similar to the Gartley but has different Fibonacci measurements. The Bat pattern is characterized by its deep retracement of the XA leg as a potential reversal zone.

The Butterfly Pattern

The Butterfly pattern is distinguished by its ‘W’ shape, with precise Fibonacci measurements for each point within its structure.

The Crab Pattern

The Crab pattern is the most precise of all the harmonic patterns. It provides a very tight potential reversal zone, which can result in a strong reversal.

Trading with Harmonic Patterns

Trading with harmonic patterns involves the identification of the patterns in the price charts and the execution of trades based on the predictions made by these patterns.

Identifying Harmonic Patterns

The first step in harmonic trading is identifying potential harmonic patterns in the market. This requires a solid understanding of the different patterns and their Fibonacci measurements.

Executing Trades

Once a pattern is identified, the trader can execute trades based on the potential reversal zones. The trader can set stop-loss orders just beyond the completion point of the pattern to limit potential losses.

Take Profit Levels

The trader should also set take profit levels at the Fibonacci retracement levels of the last leg of the pattern.

Conclusion

Harmonic trading patterns offer a systematic and objective approach to trading. They provide traders with precise price levels for trading, which can help to limit potential losses and maximize profits. However, like all trading strategies, harmonic trading requires practice and experience to master.