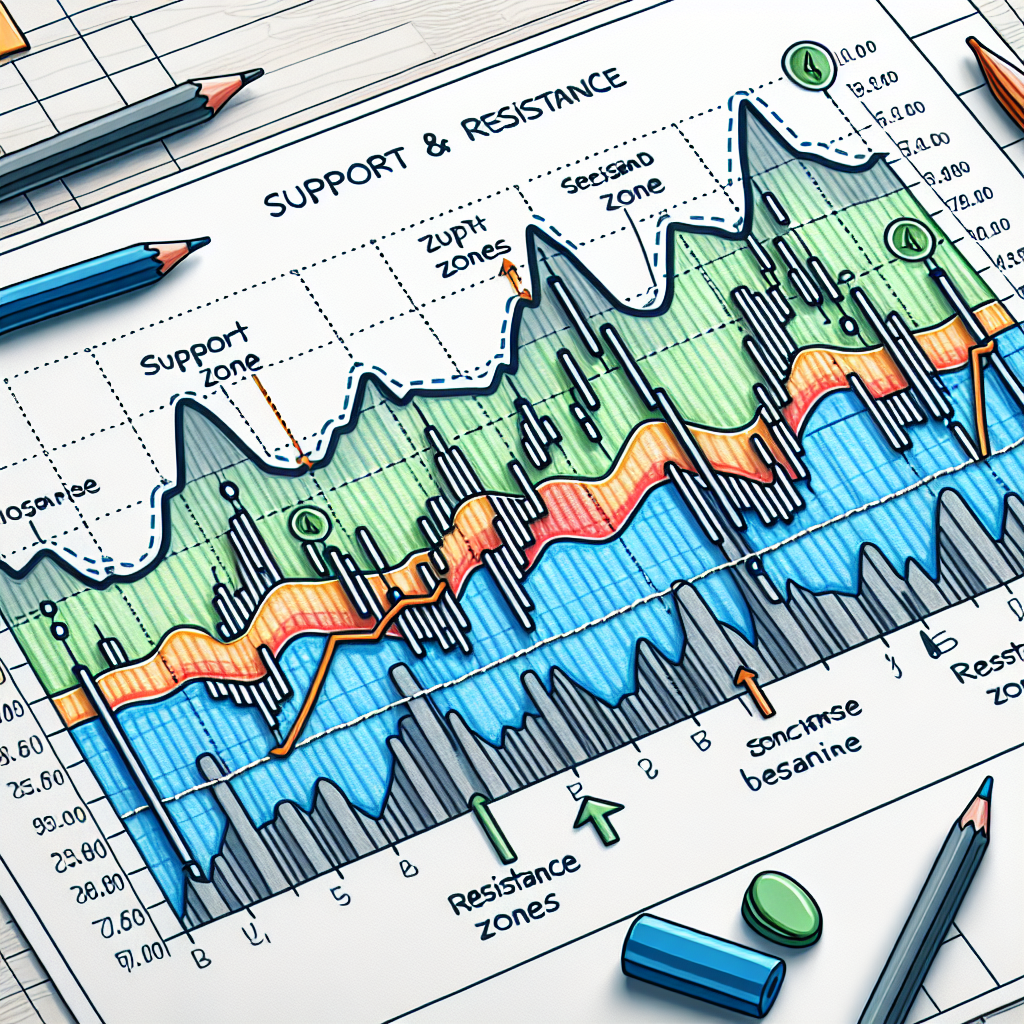

Identifying Key Support and Resistance Zones

Understanding support and resistance zones is a fundamental aspect of technical analysis in trading. These zones are crucial in predicting potential price movements and can be instrumental in determining entry and exit points for trades. In this article, we’ll delve into the concept of support and resistance zones and explore how to identify them.

What Are Support and Resistance Zones?

Before we delve into the process of identifying these zones, it’s important to understand what they are.

Support Zones

A support zone is a price level or zone where the price of an asset tends to stop falling and may even start rising. It’s the level at which buyers start to outnumber sellers, creating a demand that prevents the price from falling below the support level.

Resistance Zones

On the other hand, a resistance zone is a price level or zone where the price of an asset tends to stop rising and may start falling. It’s the level at which sellers start to outnumber buyers, creating a supply that prevents the price from rising above the resistance level.

Identifying Support and Resistance Zones

Identifying support and resistance zones involves a careful analysis of price charts. Here are some key steps to follow:

Step 1: Choose Your Chart and Time Frame

The first step in identifying support and resistance zones is to choose the appropriate chart and time frame. Bar charts and candlestick charts are the most commonly used charts for this purpose. The time frame you choose depends on your trading style. For instance, day traders might use a 5-minute chart, while swing traders might prefer a daily chart.

Step 2: Identify Swing Highs and Swing Lows

Swing highs and swing lows are the peaks and troughs that form on your chart. A swing high is a price peak, while a swing low is a price trough. These points often act as support and resistance zones.

Step 3: Draw Horizontal Lines

The next step is to draw horizontal lines at the swing highs and swing lows. These lines represent potential support and resistance zones.

Step 4: Look for Price Reactions

After drawing the lines, look for price reactions at these levels. If the price bounces off a level multiple times, it strengthens the validity of that support or resistance zone.

Using Support and Resistance Zones in Trading

Support and resistance zones can be used in various ways in trading. They can help traders identify potential entry and exit points. For instance, a trader might buy at a support level, expecting the price to bounce back up. Alternatively, a trader might sell at a resistance level, expecting the price to fall.

Conclusion

Identifying support and resistance zones is an essential skill for any trader. By understanding these concepts and how to identify these zones, traders can make more informed decisions and potentially increase their chances of success.