Introduction to the Banking Sector’s Digital Transformation

The banking sector is undergoing a significant digital transformation, driven by rapid advancements in technology and changing customer expectations. This shift is not only changing how banks operate but also how they interact with their customers. With the rise of digital platforms, mobile banking, artificial intelligence, and blockchain technology, the banking sector is moving towards a more efficient and customer-centric model.

The Need for Digital Transformation in the Banking Sector

The need for digital transformation in the banking sector is driven by several factors. Firstly, customers are increasingly expecting seamless and personalized experiences. With the rise of digital natives, banks need to provide services that are accessible, convenient, and tailored to individual needs.

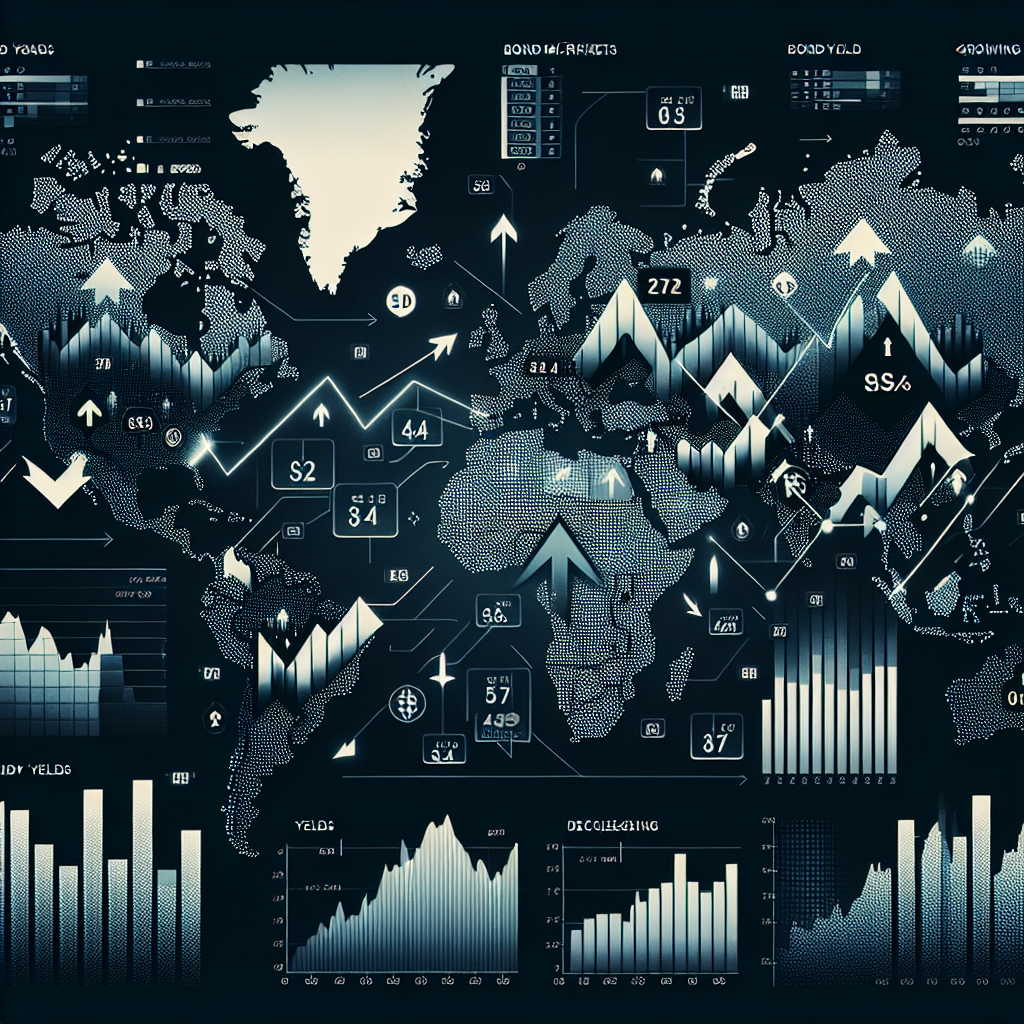

Secondly, technology is enabling new forms of competition. Fintech startups and tech giants are disrupting the market with innovative services that often offer better user experiences and lower costs.

Lastly, regulatory changes are pushing banks towards digitalization. Regulations such as Open Banking and PSD2 are encouraging banks to open up their systems and collaborate with third-party providers.

Key Elements of Digital Transformation

Customer Experience

At the heart of digital transformation is the customer experience. Banks are leveraging data and analytics to gain insights into customer behavior and preferences. This enables them to offer personalized services and improve customer satisfaction.

Operational Efficiency

Digital transformation is also about improving operational efficiency. Automation, AI, and machine learning are being used to streamline processes, reduce errors, and increase productivity.

Innovation

Banks need to foster a culture of innovation to stay competitive. This involves experimenting with new technologies, partnering with fintech startups, and creating an environment that encourages creativity and risk-taking.

Data Security

With the rise of digital banking comes increased risks. Banks need to invest in robust security measures to protect customer data and maintain trust.

Examples of Digital Transformation in Banking

Several banks are leading the way in digital transformation.

DBS Bank

DBS Bank in Singapore is often cited as a leading example. They have adopted a “digital to the core” strategy, investing heavily in technology and focusing on creating a seamless customer experience.

BBVA

Spain’s BBVA has also embraced digital transformation, with a focus on open banking. They have opened up their APIs to third-party developers and launched a number of innovative services.

Goldman Sachs

Goldman Sachs has launched Marcus, a digital bank that offers high-yield savings accounts and personal loans. This is a significant departure from their traditional investment banking business.

Conclusion

The digital transformation of the banking sector is a complex and ongoing process. It requires a shift in mindset, significant investment in technology, and a commitment to innovation. However, those banks that embrace digital transformation will be best positioned to meet changing customer expectations, stay competitive, and navigate the regulatory landscape.